In the quest to comprehend the intricate workings of cryptocurrency, we embark on a journey through a dynamic digital ecosystem characterized by decentralized networks, cryptographic principles, and a diverse array of operational components. This comprehensive guide aims to unravel the complexities surrounding crypto, offering an in-depth exploration of fundamental aspects, including blockchain technology, cryptography, mining or staking, supply constraints, transactions, and the pivotal roles played by wallets and exchanges.

Decentralization and Blockchain Technology:

Decentralization: Cryptocurrency’s departure from traditional centralized currencies is its defining feature. In lieu of authority vested in governments or financial institutions, cryptocurrencies operate on a peer-to-peer network. This decentralization ensures a democratic and transparent framework for financial transactions.

Blockchain Technology: At the core of most cryptocurrencies lies blockchain technology—an ingenious solution to the double-spending problem. This distributed ledger, maintained by a network of nodes, serves as a chronological record of all transactions. Transactions are bundled into blocks, linked through cryptographic hashes, and added to the chain through consensus mechanisms, creating an immutable and transparent transaction history.

Cryptography: Safeguarding Transactions with Keys

Public and Private Keys: To grasp the essence of cryptocurrencies, one must comprehend the role of cryptographic keys. Each participant in the network possesses a public key, serving as a visible address for transactions, and a private key, a confidential code granting access to their digital assets. The asymmetrical encryption inherent in these key pairs ensures secure and authenticated transactions.

Cryptographic Hash Functions: Transactions undergo encryption through cryptographic hash functions. These functions convert input data, including transaction details, into fixed-size strings of characters. The resulting hash uniquely identifies the data and ensures the integrity of transactions within each block.

Mining (Proof of Work) or Staking (Proof of Stake)

Mining (Proof of Work): In Proof of Work (PoW) systems, the creation of new cryptocurrency units involves miners solving complex mathematical problems. This process requires significant computational power, and the first miner to successfully solve the problem adds a new block to the blockchain. This miner is rewarded with newly created cryptocurrency and transaction fees.

Staking (Proof of Stake): Proof of Stake (PoS) systems operate on a different principle, relying on validators. Validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. These validators secure transactions and, in return, receive transaction fees and sometimes newly created cryptocurrency.

Supply Control:

Capped Supply: A notable characteristic of many cryptocurrencies is a capped supply. Bitcoin, the pioneer in this space, has a maximum limit of 21 million coins. This intentional scarcity serves to create intrinsic value, mimicking precious metals like gold and influencing the economic dynamics of the cryptocurrency.

Transactions: Navigating the Crypto Heart:

Transaction Creation: The heart of cryptocurrency lies in transactions. When a user wishes to send cryptocurrency, a transaction is created. This includes the recipient’s public key, the amount of cryptocurrency, and a digital signature created with the sender’s private key, acting as proof of ownership.

Transaction Validation: Transactions are broadcast to the network, where nodes validate their authenticity. Once validated, transactions are added to blocks. In PoW systems, miners compete to add a new block to the blockchain, while in PoS systems, validators take on this role.

Block Addition and Blockchain Formation: The process of adding blocks ensures the formation of a blockchain—a chain of blocks linked together. Each block contains a unique identifier (hash) of the previous block, creating a secure and unalterable transaction history.

Wallets and Exchanges:

Cryptocurrency Wallets: As users delve into the cryptocurrency space, wallets become indispensable tools. These can be software-based (online, desktop, mobile) or hardware-based. Wallets store public and private keys, allowing users to check balances, send, and receive cryptocurrency securely.

Cryptocurrency Exchanges: Exchanges serve as bustling marketplaces within the crypto ecosystem. These platforms enable users to buy, sell, and trade cryptocurrencies against traditional currencies or other digital assets. Exchanges play a vital role in price discovery and liquidity, providing users with the means to actively engage in the cryptocurrency market.

Now if you have made your mind to dive into the world of Crypto and don’t know where to buy or how to invest then we have listed out best platforms for crypto exchange.

Most Popular Crypto Exchanges and Apps in 2024

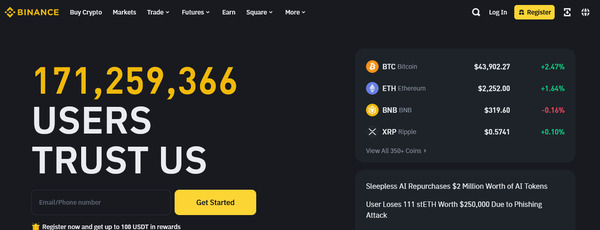

- Overview: Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers a wide range of cryptocurrencies for trading, including Bitcoin, Ethereum, Ripple, and many altcoins.

- Services: Binance provides various services, including spot trading, futures trading, staking, savings, and a launchpad for initial coin offerings (ICOs).

- Security: Binance places a strong emphasis on security, implementing measures like two-factor authentication (2FA) and cold wallet storage for the majority of user funds.

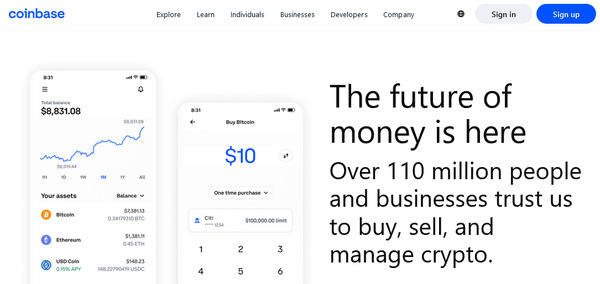

- Overview: Coinbase is a user-friendly cryptocurrency exchange and wallet platform. It is particularly popular among beginners due to its simplicity.

- Services: Coinbase offers a variety of services, including a trading platform, wallet, and an advanced trading platform called Coinbase Pro. It also provides educational resources for users new to cryptocurrency.

- Security: Coinbase follows strict security measures and is known for its regulatory compliance. It is a licensed and regulated platform in several jurisdictions.

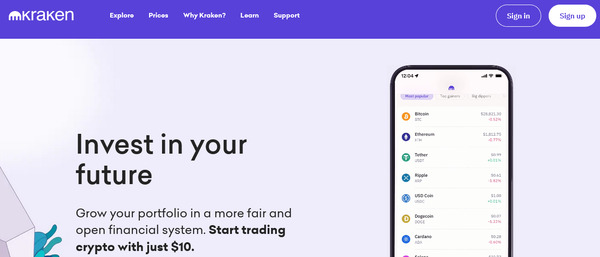

- Overview: Kraken is a well-established cryptocurrency exchange with a reputation for security and reliability.

- Services: Kraken offers a range of cryptocurrency trading pairs, futures trading, margin trading, and staking services. It provides advanced charting tools for experienced traders.

- Security: Kraken places a strong emphasis on security, using cold storage for the majority of user funds and regular security audits.

- Overview: Gemini is a U.S.-based cryptocurrency exchange founded by the Winklevoss twins. It is known for its focus on regulatory compliance.

- Services: Gemini provides a secure platform for buying, selling, and storing various cryptocurrencies. It also offers a regulated stablecoin called Gemini Dollar (GUSD).

- Security: Gemini adheres to regulatory standards and employs security measures such as cold storage, 2FA, and insurance coverage for digital assets.

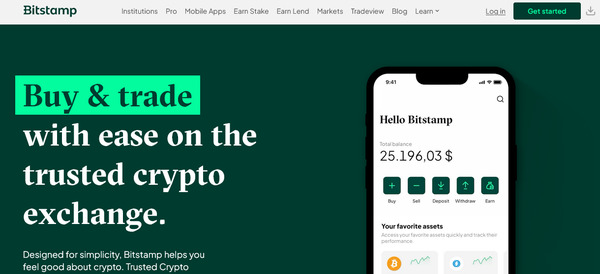

- Overview: Bitstamp is one of the longest-standing cryptocurrency exchanges, operating since 2011.

- Services: Bitstamp facilitates the trading of a variety of cryptocurrencies and offers services such as fiat-to-crypto trading and international bank transfers.

- Security: Bitstamp focuses on security and has implemented measures such as cold storage for the majority of user funds and regular security audits.

Investing in the dynamic world of cryptocurrencies can be rewarding, but it comes with inherent risks that demand careful consideration. Understanding and managing these risks is crucial for making informed decisions. Here’s a comprehensive look at the key risks associated with cryptocurrencies:

Navigating Cryptocurrency Risks: What You Need to Know

- Price Volatility

Cryptocurrency markets are renowned for their high volatility, with prices experiencing significant swings within short timeframes. While this volatility offers potential gains, it also exposes investors to substantial losses.

- Market Risk

External factors such as market sentiment, regulatory changes, macroeconomic trends, and technological advancements can influence cryptocurrency markets. Traders must be aware of these factors as they impact both the overall market and individual cryptocurrency prices.

- Regulatory Risk

Regulatory developments and uncertainties pose a significant risk to the cryptocurrency market. Changes in regulations or government policies can impact the legality, acceptance, and valuation of cryptocurrencies, creating an ever-changing landscape.

- Security Risks

The persistent threat of hacking and cyber attacks remains a concern in the cryptocurrency space. Users must prioritize securing their private keys and choose platforms with robust security measures to mitigate the risk of fund loss.

- Technology Risks

Cryptocurrencies rely on evolving blockchain technology. Technological vulnerabilities, software bugs, and network upgrades can impact functionality and security. Users should stay informed about potential risks related to blockchain-based applications.

- Operational Risks

Issues like system failures, outages, or technical glitches on cryptocurrency exchanges can hinder users’ ability to trade or access their funds. Opting for reliable and established platforms is crucial to mitigate operational risks.

- Liquidity Risk

Low liquidity in some cryptocurrencies, especially smaller ones, may pose challenges for users looking to buy or sell assets at desired prices. This can result in higher slippage during trades.

- Counterparty Risk

Users of centralized exchanges face counterparty risk, relying on the exchange to fulfill transactions and withdrawals. Financial or operational issues on the exchange side can impact users’ access to their funds.

- Legal and Compliance Risks

Cryptocurrency regulations vary globally, and users may face legal and compliance risks if they unknowingly violate regulations. Staying informed about regulatory changes and adhering to local laws is crucial.

- Market Adoption and Perception

Cryptocurrency markets are influenced by public perception and adoption. Negative sentiment, media coverage, or skepticism about the legitimacy of cryptocurrencies can affect market dynamics.

- Loss of Private Keys

Cryptocurrency ownership hinges on private keys, and the loss or compromise of these keys can result in permanent fund loss. Users should implement secure practices for key management.

In conclusion, unraveling the mechanics of cryptocurrency demands a comprehensive exploration of its foundational elements. From decentralization and blockchain technology to cryptography, mining or staking, supply constraints, transactions, wallets, and exchanges, each component contributes to the intricate tapestry of the crypto landscape. As this digital realm continues to evolve, understanding these dynamics becomes paramount for those navigating the fascinating world of cryptocurrency.